At NORTH, you get innovative, value-adding company pension advice based on a well-developed advisory and support organization and a wide range of complete pension and healthcare plans.

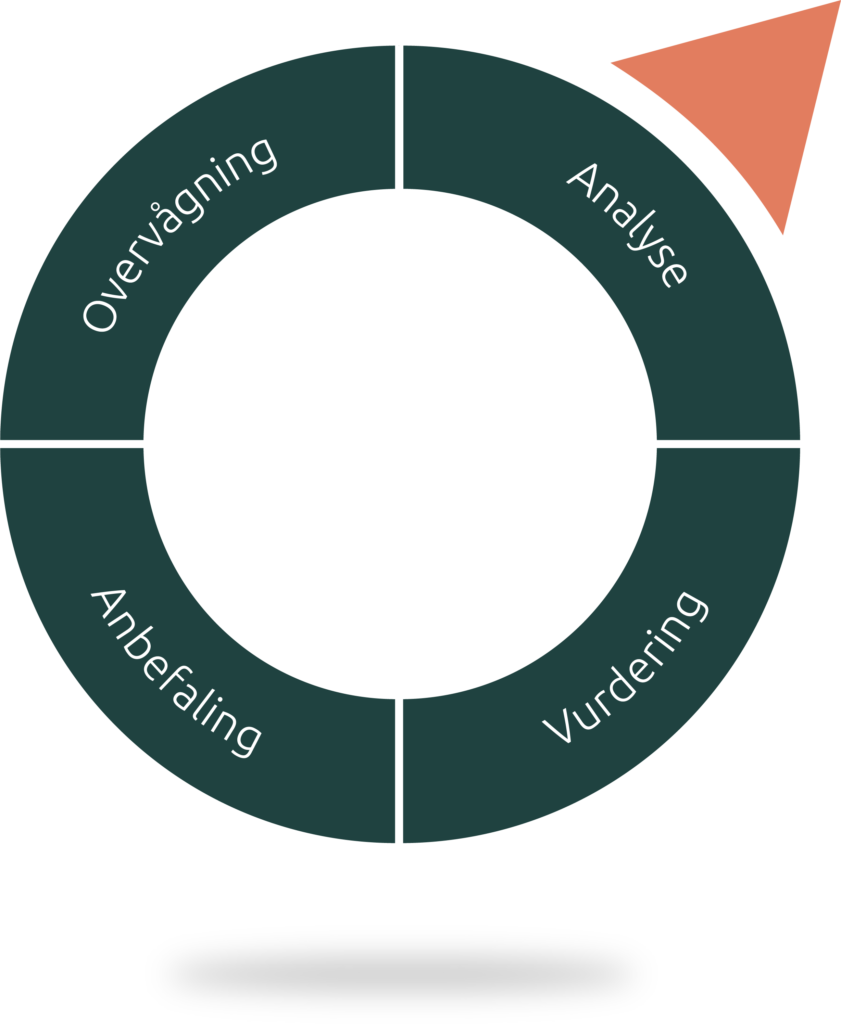

Analysis: By analyzing your company’s current pension profile and the situations and needs of your employees, we create an overview of your pension needs now – and in the future.

Assessment: Based on the analysis, we assess your current risk profile, so we can both identify new preventive initiatives and suggest ways to improve your current company pension plan. This gives us a solid foundation for our recommendations to you and your employees.

Recommendation: We present you with our recommendations for prevention initiatives to give you the best possible overview of all the coverages that will ensure a strong company pension plan. We can also, for example in connection with tenders, help you negotiate with the relevant company pension providers – with very little involvement on your part. This gives your business both the right coverages and the right prices.

Monitoring: We continuously monitor each employee’s retirement plan based on milestones, so she always knows if she’s on the right track. SamAt the same time, we are constantly working to identify new and better solutions for individual employees.

The complexity of the corporate pensions market is constantly increasing. At the same time, Covid-19 has had some sad consequences in the form of a large increase in sick leave and long-term mental and physical injuries. This means that many insurance companies have both increased prices and worsened terms and conditions.

That’s why, more than ever, you need an independent pension broker with strong negotiating power to give you and your employees an overview – and ensure you get the right coverage at the right price.

At NORTH, we always take a tailored approach to pension plans. Because it works. Based on The NORTH Way, we start with an analysis of your company’s current pension profile and the situations and needs of your employees. As a direct extension of this, we provide a rock-solid risk assessment with thorough recommendations for prevention initiatives, and we continuously monitor employees’ retirement goals. This approach ensures your company and your employees receive world-class advice and a world-class company pension plan.

The pension market is complex and constantly evolving. In recent years, there has been a consolidation among commercial pension companies. At the same time new players have have on the market, including a number of labor market–pension companieswho want to challenge the established commercial companies.

The Danish FSA is working to balance the pension companies’ deficit on insurance coveragee. They do this to stem the tide cross-subsidization, where pension companies finance insurance deficits via earnings on customers’ pension savings.

Pension saverss efter demandfor for green investments has increased significantly in recent years. We are confident that this trend will continue and fexpect to see an increase in demand for iin particular low-cost, passively managed investment opportunities.

In recent years, pension companies have invested heavily in self-service solutions for their customers. This means that many customers miss the opportunity for personalized virtual and physical meetings.

The devil is in the detail

In a complex and changing market, the devil is in the detail more than ever. Even minor differences in conditions can make a big difference to the company and employees. We therefore set a large

pride ourselves in

focusing on the details so we can guide you and your employees

to choose the right individual solutions.

Risks across products

We incorporate data and knowledge from all relevant suppliersr. This enables us to offer strong advice and unique solutions.

Experienced people

He have it high priority attracting and retain the most talented employees in the industry – because education andeducation and experience are important when guiding customers. Dhat’s why wei also have detailed training plans for all employees. Og the large number of colleagues with a license makes us proud.

Danish Financial Supervisory Authority

We are approved as an independent insurance intermediary by the Danish Financial Supervisory Authority.

We guide and help you realize your employees’ dreams for the future through strong pension solutions. Solid data and knowledge gathering ensures that we can create a thorough assessment of your current pension profile – based on your employees’ situations and expectations. At the person level, we start with the individual coverage need, which is monitored with a focus on the mapped milestones. This means we can have an effective and targeted dialog with

pension companies, so we can find the right solution for the individual, individual employees or the company as a whole.

We continue to see a lot of competition between the different providers. Therefore, we recommend competitive tendering or renegotiating the pension plan and health insurance. This ensures that the agreements are competitive and attractive in terms of both price and quality.

For us, data insight and due diligence are key to achieving optimal employee wellbeing and security. Based on data and evidence, we guide you to ensure both solid injury prevention and fast, effective help for sick employees.

At NORTH, we know that the best pension and health plan is created in a close and mutually respectful collaboration with the companies. We don’t want to be perceived as a competitor to the companies, but rather as the trustworthy and competent guide that creates added value for both the company and the employees.

For many, pensions are a low interest area because they seem complicated and confusing. But because we guide both the company and employees with simple rules of thumb and ongoing follow-up, the whole process becomes a smooth, manageable experience for everyone.

Fill out the form if you are interested in learning more about your options or if you have questions about pensions and life insurance. We help you find the right solution for your employees.

Contact Partner and Director, Thomas Ammonsen, for a no-obligation chat about pension.

Thomas can be reached Mon – Fri 9 – 16.

Call +45 31 39 98 33

Write to [email protected]

Stay up to date by following us on LinkedIn, where we frequently publish insights and advice on business insurance, M&A, company pensions, mortgage advice and financial procurement. We’ve made it easy for you. Tap the button to follow us.

Welcome to the “Det skete bare ikke!” podcast! – A podcast for CFOs. Here we dive into fascinating stories of unforeseen events that have impacted businesses. We publish every fortnight, inviting exciting guests into the studio.

North Risk A/S

Nørgaardsvej 32

2800 Lyngby

CVR: 42248789

Opening hours: Mon – Fri 9 – 16.

Call us 81 80 75 20

Write to [email protected]

2023 - All rights reserved - NORTH